Monthly budget planning is so much more than just crunching numbers it’s a plan for living free, safe and strong in your financial life. In the internet age, where spending can occur with a single click and subscriptions quietly siphon away funds, it is important to have a structured budgeting system in place for long-term financial wellness.

Whether people are professionals, entrepreneurs, in family situations or still studying-we all need a clear roadmap for budgeting with a good system in place, monthly budget planning is more of a way of life than an ordeal! Drawing on expert insight, real-life concepts and a healthy dose of skepticism toward the world of personal finance experts, this guide serves as an approachable and action-oriented resource that prepared to help you build a sustainable money system you can not only live with but truly enjoy.

You will learn to brainstorm and use a family budget planner, develop a flexible personal budget template, practice money management using an easy expense tracker, develop smart money habits for finance success and apply simple money management tips that can work wonders in real life.

How Monthly Budget Planning Is Key to Financial Success

It’s easy to see where your money is going with monthly budget planning. It converts income into something structured, rather than random spending.

It answers three core questions:

- How much money do I earn?

- Where is my money going?

- Where should I put my money?

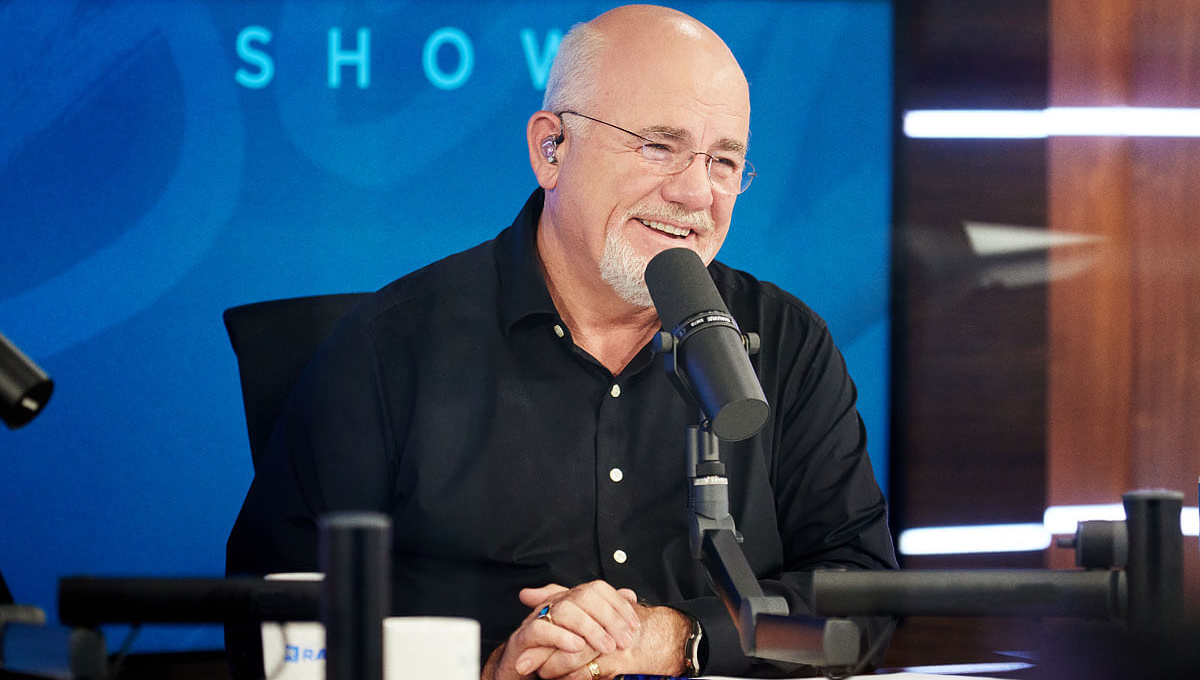

Prominent personal finance guru Dave Ramsey often says that budgeting is not deprivation, it is simply telling your money where to go instead of wondering where it went. And this is the underlying philosophy behind effective monthly budget planning.

Benefits include:

- Reduced financial stress

- Strong saving discipline

- Debt reduction

- Emergency preparedness

- Financial clarity

- Lifestyle balance

- Long-term wealth creation

With the right template for a monthly budget, you no longer make financial decisions based on your feelings.

Smart Money Habits to Transform Your Financial Life

Learning smart money habits are what drive the vehicle of Monthly budget planning downstream. Without habits a system is pointless.

Examples of powerful habits:

- Weekly expense reviews

- Automated savings

- Conscious spending

- Delayed gratification

- Lifestyle budgeting

- Digital spending limits

- Emergency fund building

Financial advisor Suze Orman emphasizes emotional discipline in money decisions because behavior shapes financial outcomes more than income levels.

Expense Tracker: The Mirror of Your Financial Reality

An expense tracker creates awareness. It reveals spending habits, hidden fees and money leaks.

Some popular budgeting tools and apps are:

It is not easy to maintain a budget each month, discover these platforms that take the hard work out of monthly budget planning through automated tracking and categorization of what you spend on.

Family Budget Planner v/s Personal Budget Template

Different lifestyles need different structures.

Family budget planner focuses on:

- Household income

- Rent or mortgage

- Utilities

- Education

- Healthcare

- Groceries

- Child-related expenses

- Emergency savings

Personal budget template focuses on:

- Individual income

- Career growth

- Lifestyle spending

- Travel planning

- Personal development

- Savings goals

- Investment planning

They’re based on the same underling structure but between priorities they’re a bit different.

The Structure of the Ideal Monthly Budget Template

To achieve effective monthly budget planning,

Category | Description | Allocation Type |

Income | Salary, business, side income | Total inflow |

Fixed Expenses | Rent, utilities, internet | Stable |

Variable Expenses | Food, transport, shopping | Flexible |

Savings | Emergency+goals | Minimum 20% |

Investments | Long-term wealth | Growth |

Lifestyle | Travel, entertainment | Balanced |

This format serves as both a family budget planner and a template for your personal budget.

Budgeting Discipline Enhancing Banking Systems

Modern banking supports budgeting automation. Major banks including Chase Bank, Bank of America, Barclays bank and HSBC are dealing with:

- Budgeting insights

- Expense categorization

- Automated savings

- Digital alerts

- Financial dashboards

- Spending controls

This improves monthly budget planning through automation and visibility.

Smart Money Habits for the Digital Age

Modern spending is invisible:

- Subscriptions

- Apps

- Online shopping

- Digital wallets

- Auto-renewals

- Micro-transactions

Monthly budget planning must include:

- Subscription audits

- App spending limits

- Digital wallet tracking

- Auto-renewal reviews

- Spending alerts

- Payment method control

This is how smart money habits shift in the age of digital lives.

Tips for Practical Money Management that Work in Real Life

Sound money management tips are based on simplicity:

- Pay yourself first

- Separate savings accounts

- Build emergency buffers

- Track every expense

- Limit lifestyle inflation

- Automate bills

- Create sinking funds

- Set financial goals

These tools make monthly budget planning effortless and lasting.

Per Month Budget Planning as a Long-Term Wealth Strategy

Budgeting isn’t just short-term survival it’s long-term growth.

What is claimed is a monthly budget planning system that is scalable comprising:

- Flexible categories

- Goal-based budgeting

- Emergency fund scaling

- Investment planning

- Lifestyle upgrade planning

- Income growth alignment

This transforms budgeting into wealth-building.

Budgeting Mistakes to Avoid

Avoid:

- Unrealistic targets

- No tracking system

- No emergency fund

- Emotional spending

- Overcomplicated systems

- No review process

- No long-term goals

These errors compromise the consistency of monthly budget planning.

Final Thought

Freedom from income doesn’t come from earning more that freedom comes from structure. Take control with a proper monthly budget plan, robust game plan for a month template, trustworthy & easy tracker for expenses, proven smart money habits and wise money management tips to build a safe and secure financial future!

Whether you are managing a household budget with a family budget planner and personal financial system or planning for your future success, budgeting is the first step in giving yourself stability, building confidence and fostering long-term growth.

Start today- Manage your money don’t let it manage you.

FAQs

- What is Monthly budget planning?

A financial system that places monthly income, expenses, savings and goals in-order to have fund control and clarity.

- What are a few benefits that families get from budget planners?

The family budget planner, assists in efficiently keeping track of the combined income, household expenses, emergency funds and long-term financial objectives.

- Why we need expenses tracker?

Such an expense tracker can be used to track expenses, plug leaks and develop better financial awareness.

- What are the features that make a personal budget template excellent?

A good personal budget template will include income tracking, expense categories, savings goals and even lifestyle planning.

- How does Monthly Budget Planning contribute to smart money habits and tips for money management?

The perfect amount of mindful money tools to develop smart thinking finance habits, practice powerful principles as in budget planners set year goals and -long financial power with detailed money organiser tips and tricks using a good system for budgets.